Although the psychedelics industry is being built as the airplane flies, not every aspect of doing business needs to be re-invented. Insurance may be less exciting than novel compounds, but having the appropriate policies is key to unlocking the industry and getting through the Food and Drug Administration (FDA) approval process. And fortunately, all of the policies your psychedelics company needs already exist.

Here’s what you need to know about psychedelics insurance and getting through the FDA approval process.

Understanding the FDA Drug-Approval Process

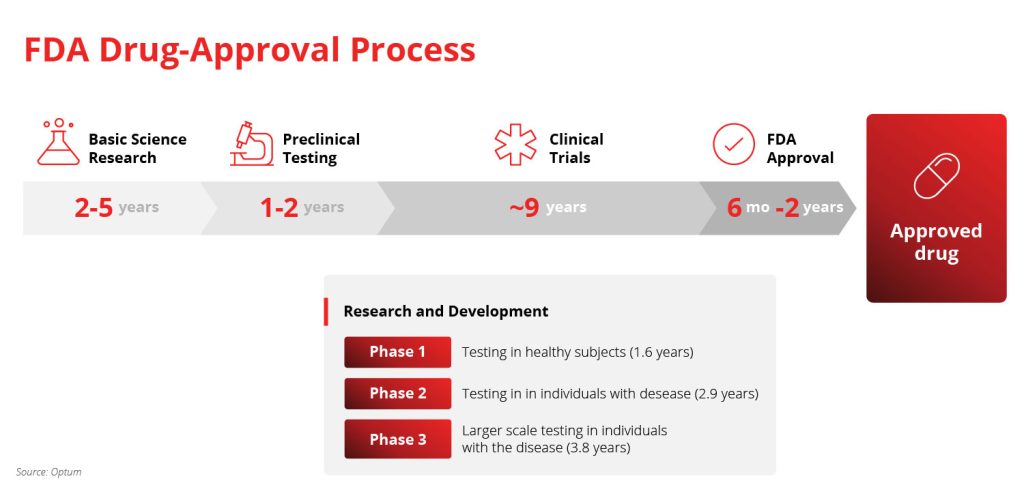

All regulated compounds in the US have to go through the FDA approval process. But the necessity of doing so doesn’t mean it will be quick. The process is not for the faint of heart — a generous estimate for moving through the process is nine years, while a conservative estimate puts the process closer to 15 years.

Why does it take so long? Each stage of the FDA process can take years to move through because there’s no rushing the research it takes to prove substances are safe.

The stages are:

- Basic research: 2 – 5 years

- Pre-clinical testing: 1 – 2 years

- Clinical trials: ~9 years, with 3 phases

- Phase 1: healthy human testing to establish a baseline

- Phase 2: clinical trials with volunteers from the target audience

- Phase 3: larger scale clinical trials with affected individuals

- FDA approval: 6 months – 2 years

Even getting to phase three in the clinical trials stage is an accomplishment, as many compounds don’t make it that far — only 1 out of every 5,000 compounds makes it. Of those, only 1/5 will be approved by the FDA.

How to Manage Risks During the FDA Drug-Approval Process

Research and development of novel psychedelic compounds is a hotbed of risks and liability. But innovation demands risk, and the benefits of an established, regulated industry outweigh the risks. Protecting your business and bottom line involve steps that you can take to assess exposures and create a risk management plan (your safety net.)

- Know what you’re up against: You know the process won’t be smooth sailing, so prepare now. Familiarize yourself with the approval process, FDA regulations, and industry statistics. Every challenge can seem insurmountable until it’s broken down.

- Quality assurance is a must: QA is a significant concern during manufacturing, primarily because of supply chain uncertainty — especially in our post-pandemic world. Assess your manufacturing process and identify potential quality assurance issues before they arise. This approach gives you time to develop a plan for how to deal with them, from band-aid solutions to a total pivot.

- Protect your digital assets: Cybersecurity is more of an issue now than ever before. Patient data is private, and a massive data breach is the quickest way to ruin a reputation before a compound has even made it to market. Not only are cyberattacks more vicious and frequent, but psychedelics companies must worry about data protection during clinical trials.

- Don’t advertise off-label uses: Life sciences companies, including psychedelics, always face the risk of individuals not using the drug as intended. Sometimes there are off-label uses that become popular but aren’t FDA-approved and shouldn’t be marketed. While off-label uses are not uncommon in pharmaceuticals, they can be a considerable risk for fledgling companies.

- Establish boundaries and processes with investors: Psychedelics companies must manage investors’ involvement and foster healthy relationships to avoid dissatisfaction and, worse, lawsuits.

- Ensure the safety of your workers: Workplace safety is a growing concern in the life sciences industry. The tragic passing of a cannabis worker in Massachusetts highlights the importance of never cutting corners. When companies prioritize worker safety, the downstream results are happy employees and better product quality.

- Insure your equipment: Research and development (R&D) is a costly sector, and sometimes things break without warning. Having your machines insured means you don’t have to break into the rainy day fund to replace an essential piece of equipment. Replacing high-end equipment and tools could set a psychedelics company back financially without a safety net.

Recommended Insurance Policies for Psychedelics Companies

Navigating the necessary psychedelics insurance policies can be confusing (at the least.) Working with a team that understands you, your needs, and the industry means you can move forward confidently, knowing that you’re protected.

General Liability

General liability offers broad protection against some of the most fundamental risks psychedelics companies face. Known as “slip-and-fall” or “all-risk” insurance, this policy covers personal or property damage and bodily injury occurring on the business premises.

Property

This policy is first-party coverage that protects the Total Insurable Value (TIV) of your operation’s property, reimbursing psychedelics companies for direct property losses.

Workers’ Compensation

Employers are typically responsible for medical costs and lost wages when employees sustain work-related injuries. This policy covers these expenses, protecting employees while keeping psychedelics companies running smoothly.

Employment Practices Liability

Psychedelics companies with any number of employees face the risks of allegations, such as discrimination, wrongful termination, breach of contract, etc. This coverage protects psychedelics companies against lawsuits related to employment practices.

Product Liability

Psychedelics companies offering tangible products or services risk third-party lawsuits claiming bodily injury or property damage. Product liability insurance covers defense fees and settlements, even for ungrounded claims. This coverage is particularly critical in the psychedelics space as testing and manufacturing aren’t yet regulated at the federal level.

Directors & Officers

Shareholders, competitors, investors, etc., can sue a psychedelic company’s executives, putting their personal assets at stake. Directors and officers (D&O) insurance protects these assets from lawsuits alleging leaders of wrongful acts managing the business.

Cyber Liability

Cyber insurance protects companies from third-party lawsuits relating to electronic activities (i.e., phishing scams). Plus, it offers many recovery benefits, supporting data restoration and reimbursement for income lost and payroll spent.

IP

Companies are often accused of infringement or face being infringed upon, putting their budget and intellectual property at risk. This policy covers legal fees and offers enforcement coverage, no matter how grounded or not the claim is.

Professional Liability

Professional liability, also known as errors and omission (E&O) insurance, covers psychedelics companies in third-party or client lawsuits claiming substandard work or service. Work errors or oversights, missed deadlines, budget overruns, etc., often result in costly cases — but E&O insurance responds to these mishaps.

Clinical Trials

This coverage protects the sponsors or organizers of clinical trials for drug and medical device testing, covering their legal liability to pay compensation in the event of an injury to a trial participant.

Protecting your psychedelics company can seem confusing; however, we’re a full-service insurance brokerage working with carriers worldwide to offer you the best coverage possible. We’re here to help! Please reach out to us today by emailing [email protected] or calling 646-854-1093 for a customized letter of commitment or learning more about your cannabis insurance options.