Cannabis Insurance

in North Dakota

The cannabis industry is ever-changing and has many layers of regulations. Navigating these regulations and ensuring your business for long-term success is our passion. Being insured is a great idea to keep your business safe.

- Introduction to Cannabis Insurance in North Dakota

- Navigating the Risks: Why Insurance is Essential

- Types of Cannabis Insurance Coverage Available

- Benefits of Having the Right Cannabis Insurance

- Consulting with Cannabis Insurance Specialists

- Cannabis Insurance FAQs

- Speak to a Cannabis Insurance Advisor

Introduction to Cannabis Insurance in North Dakota

Navigating the cannabis industry in North Dakota requires an understanding of the unique risks and regulatory requirements involved. Cannabis insurance provides crucial coverage to protect businesses from various liabilities and ensure compliance with local laws.

Overview of North Dakota's Cannabis Industry

North Dakota’s legal cannabis industry is primarily focused on medical use, with a regulated market that provides patients access to cannabis for medicinal purposes. Recreational cannabis remains illegal, but the industry continues to grow and evolve.

The US Cannabis industry is expected to cross 71 Billion Dollars by 2030. Legalizing the possession and sale of cannabis will open the doors to the billion-dollar cannabis industry and benefit North Carolina’s economy.

North Dakota Cannabis Laws and Regulations

Medical cannabis was legalized in North Dakota in 2016 with the passage of Measure 5. The state regulates the industry through the North Dakota Department of Health, which oversees licensing and compliance for dispensaries, cultivation facilities, and patients. Recreational cannabis remains illegal, and any changes to this status are subject to future legislative efforts.

Recreational cannabis is not legal in North Dakota. Efforts to legalize it have been made but have not succeeded:

- 2018 Initiative: Measure 3, which would have legalized recreational cannabis, was defeated in the November 2018 election.

- Legislative Efforts: Subsequent attempts to pass legislation or initiatives for recreational cannabis have not yet been successful.

Understanding the Importance of Insurance for Cannabis Businesses

Cannabis businesses face unique risks that require specialized insurance coverage. Cannabis insurance helps mitigate these risks, ensuring that businesses remain compliant with state laws and are protected against potential financial losses.

- Legal Compliance: Insurance can help meet state regulatory requirements, which often mandate certain types of coverage.

- Risk Management: It provides protection against various risks, including property damage, theft, crop failure, and liability issues.

- Financial Security: Insurance helps safeguard the business’s financial stability by covering potential losses that could otherwise be catastrophic.

- Credibility and Trust: Having comprehensive insurance can enhance the credibility of a cannabis business with investors, partners, and customers.

- Protection from Litigation: The cannabis industry is prone to legal challenges and disputes. Insurance can cover legal fees and settlements.

Types of Cannabis Insurance Coverage Available

General liability insurance covers bodily injury, property damage, and personal injury claims that may arise during business operations. This type of insurance is essential for protecting cannabis businesses from lawsuits and financial losses due to accidents or negligence.

Learn MoreCannabis crop insurance protects cultivators against losses due to crop failure, pests, weather conditions, and other unforeseen events. This coverage ensures that growers can recover their investments and continue their operations even in adverse circumstances. Outdoor crops are more exposed to natural threats.

Learn MoreProduct liability insurance covers claims related to the safety and quality of cannabis products. This insurance is crucial for protecting businesses from lawsuits arising from product defects, contamination, or adverse reactions experienced by consumers. A comprehensive dispensary insurance must have this coverage because there are a lot of emerging risks that a business can get from selling a finished stock of medicinal use marijuana. Any adverse reaction or harm that a cannabis product did to a customer is bad for your business.

Learn MoreProperty insurance provides coverage for physical assets, including buildings, equipment, and inventory. This insurance protects cannabis businesses from losses due to fire, theft, vandalism, and other business personal property damage incidents.

Learn MoreDirectors & Officers insurance protects the personal assets of company directors and officers from legal claims related to their management decisions. This coverage is essential for safeguarding leadership against lawsuits and ensuring the stability of the business.

Learn MoreWorkers’ compensation insurance covers medical expenses and lost wages for employees who are injured or become ill due to their job duties. This and casualty insurance is mandatory in most states and helps protect businesses from significant financial liabilities.

Learn MoreBusiness interruption insurance compensates for lost income and operating expenses if a business is forced to close temporarily due to a covered event. This coverage ensures that cannabis businesses can maintain financial stability during disruptions.

General liability insurance covers bodily injury, property damage, and personal injury claims that may arise during business operations. This type of insurance is essential for protecting cannabis businesses from lawsuits and financial losses due to accidents or negligence.

Learn MoreCannabis crop insurance protects cultivators against losses due to crop failure, pests, weather conditions, and other unforeseen events. This coverage ensures that growers can recover their investments and continue their operations even in adverse circumstances. Outdoor crops are more exposed to natural threats.

Learn MoreProduct liability insurance covers claims related to the safety and quality of cannabis products. This insurance is crucial for protecting businesses from lawsuits arising from product defects, contamination, or adverse reactions experienced by consumers. A comprehensive dispensary insurance must have this coverage because there are a lot of emerging risks that a business can get from selling a finished stock of medicinal use marijuana. Any adverse reaction or harm that a cannabis product did to a customer is bad for your business.

Learn MoreProperty insurance provides coverage for physical assets, including buildings, equipment, and inventory. This insurance protects cannabis businesses from losses due to fire, theft, vandalism, and other business personal property damage incidents.

Learn MoreDirectors & Officers insurance protects the personal assets of company directors and officers from legal claims related to their management decisions. This coverage is essential for safeguarding leadership against lawsuits and ensuring the stability of the business.

Learn MoreWorkers’ compensation insurance covers medical expenses and lost wages for employees who are injured or become ill due to their job duties. This and casualty insurance is mandatory in most states and helps protect businesses from significant financial liabilities.

Learn MoreBusiness interruption insurance compensates for lost income and operating expenses if a business is forced to close temporarily due to a covered event. This coverage ensures that cannabis businesses can maintain financial stability during disruptions.

Expert Advice: Choosing the Right Policy in the Cannabis Insurance Industry

How to Evaluate Your Insurance Needs

Evaluating insurance policy needs involves assessing the specific risks faced by your cannabis business. Consider factors such as the size of your operation, the value of your assets, and the potential liabilities you might encounter.

Factors to Consider When Choosing Cannabis Insurance

When selecting cannabis insurance, consider the following factors: coverage limits, policy exclusions, the reputation of the insurance provider, and the specific needs of your business. It’s essential to choose a policy that offers comprehensive protection and aligns with your operational requirements.

Benefits of Having the Right Cannabis Insurance

Safeguards Your Investments

Cannabis insurance protects your financial investments by covering losses due to unforeseen events. With the right coverage, your cannabis cultivation, cannabis extraction and retail operations can achieve long-term success.

Compliance with State Regulations

Insurance ensures that your business complies with state regulations, avoiding fines and legal issues.

Business Continuity

Coverage for business interruptions helps maintain financial stability during unexpected disruptions. Property damage caused by natural elements is covered by commercial property insurance.

Legal Defense Coverage

Insurance provides legal defense against lawsuits, protecting your business from significant legal expenses.

Workers' Compensation

Workers' compensation coverage helps protect your business from financial liabilities related to employee injuries and workplace accidents. This should always be part of employee benefits in all cannabis companies.

Consulting with Cannabis Insurance Specialists

We are a full-service insurance brokerage that focuses exclusively on the cannabis, hemp, CBD, holistic medicine, and psychedelic industries. We work with companies across the entire supply chain, from seed to sale, as well as with ancillary and capital providers. Our team is heavily invested in these industries, and our goal is to help companies scale to propel them forward.

Comprehend Unique Risks: Insurance providers understand the unique risks associated with cannabis operations and can tailor insurance policies accordingly.

Navigate Coverage Options: Experts can help navigate the various insurance options available and recommend the best coverage for your needs.

Mitigate Financial Loss: Consulting with specialists ensures that you have adequate coverage to mitigate potential financial losses.

Align with Regulations: Specialists can help ensure that your insurance coverage aligns with state and federal regulations, maintaining compliance.

Cannabis Insurance FAQs

All cannabis related businesses, including dispensaries, cultivators, processors, and ancillary businesses, need insurance to protect against various risks and ensure compliance with state laws.

Cannabis liability coverage is important because it protects businesses from lawsuits and claims related to bodily injury, property damage, and product defects. This coverage helps safeguard the business’s financial stability.

Reducing cannabis insurance premiums can be achieved by implementing risk management practices, maintaining a clean claims history, and working with an experienced insurance broker to find the best coverage options at competitive rates.

If your cannabis insurance claim is denied, review the denial letter to understand the reason, gather all relevant documentation, and contact your insurance provider to discuss the issue. If necessary, seek legal advice to challenge the denial.

Changes in regulations can impact insurance requirements and coverage options. It’s essential to stay informed about regulatory updates and work with insurance specialists to adjust your policies accordingly. Hopefully, cannabis becomes legal under the Federal Law as no longer a controlled substance.

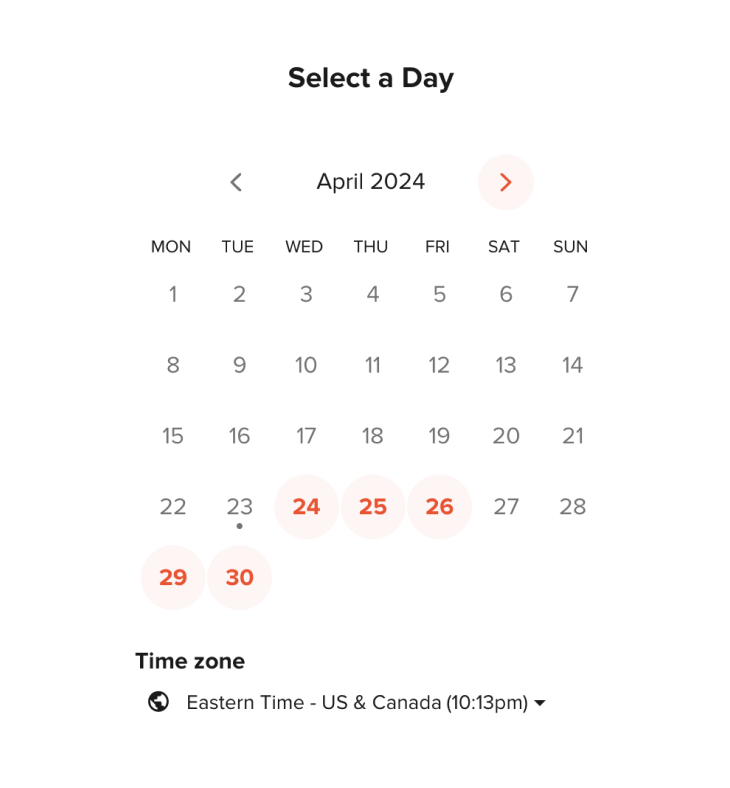

Speak to a Cannabis Insurance Advisor

To ensure your cannabis business is adequately protected, obtain a quote from a reputable cannabis insurance provider. They can offer tailored solutions that address your specific needs and help you navigate the complexities of the cannabis industry.

By securing the right cannabis insurance coverage, you can safeguard your investments, comply with state regulations, and ensure the continuity of your business in North Dakota’s evolving cannabis market.