How to Get Cannabis Insurance in New Jersey

Navigating the world of cannabis insurance in New Jersey can be complex, especially given the evolving legal landscape and unique risks associated with the industry. This guide will help you understand the essential requirements for obtaining cannabis insurance, the various types of coverage available, and the importance of partnering with a knowledgeable insurance broker to ensure your business is adequately protected.

New Jersey legalized recreational cannabis early in 2021, bringing the number of online states to 19 total as of writing this post on June 14, 2022. In case you haven’t noticed, the marketplace is booming. Naturally, our team at AlphaRoot is thrilled since we’re only across the state lines. Supporting cannabis companies that operate so close to home is tremendous. So, let’s talk about our insurance world for a while — how do you get cannabis insurance in New Jersey anyway?

Know Your Risks

Let’s get one thing out of the way right off the bat; no matter the space in which your company operates, all organizations face risks. And risks abound. For example, there are basic risks of merely doing business and risks reserved for specific industries.

Think about the notorious “slip-and-fall” scenarios popularized by headlines and breaking news. Or, consider competitors caught up in a legal frenzy over something to do with their branding or messaging. It’s safe to say, every business under the sun must face some murky water now and then. Plenty of legit and frivolous lawsuits exist, after all.

Pro Tip ↓

Need to stay update on cannabis news in New Jersey? Here’s a great place to start: New Jersey Issues Conditional Cannabis Licenses

However, the fun begins when businesses navigate industry-specific risks. For starters, the cannabis industry faces loads of challenges operating in a cash-only environment. Of course, the SAFE Act might change that soon, but financing is often like running the gauntlet for now.

Cannabis companies have many roadblocks to cross. What’s more, dispensaries face theft and property damage. Cultivators face workplace safety and legal liability. Everyone faces cybersecurity and regulatory issues. Even though things are changing quickly, it’s still a challenging industry in which to operate. We should know; we are a cannabis operator who just happens to be in insurance.

Fulfill Your Requirements

With the maze of US regulations that cannabis companies must navigate, an excellent approach to getting insurance is to start with the basics. Understand what New Jersey requires regarding new cannabis businesses, and then get it.

Thankfully, New Jersey isn’t shy about communicating its precise requirements. (Hint: it’s here in the Notice of Application Acceptance for Personal Use Cannabis Licenses.) The following are a few of those must-haves.

Conditional License Application Score Measures

Other mandatory application requirements exist for all applicants, such as your legal name and primary address, a complete Entity Disclosure Form, a waiver of liability, and plenty more. In addition to many of these standard requirements, each business type has its requirements, such as zoning approval and evidence of local code compliance. Applicants can find all criteria on the Notice of Application Acceptance.

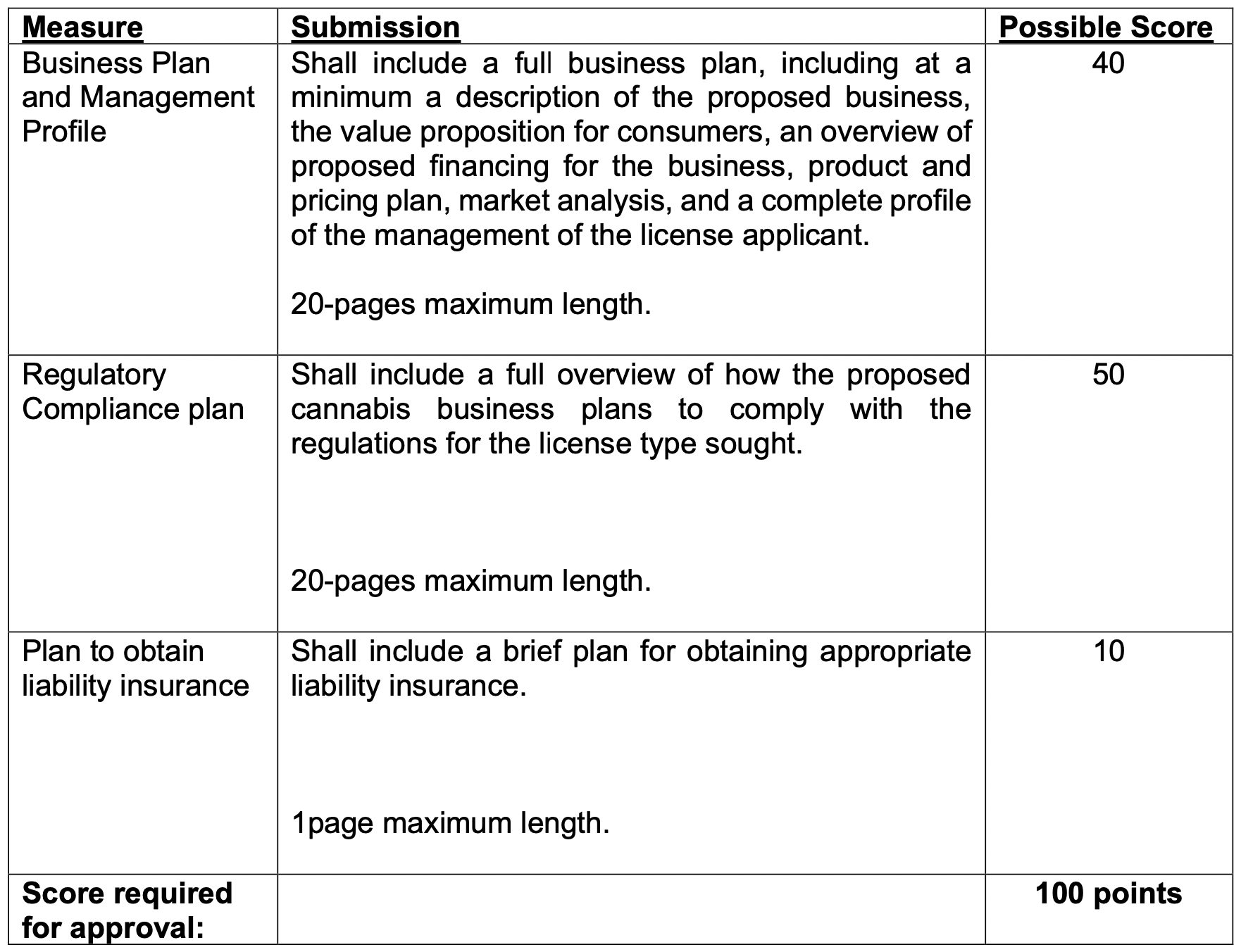

While Classes 1, 2, and 5 must navigate different application requirements, every type must score 100 points for approval on the Conditional License Application Scored Measures. Here’s a shot from the actual Notice of Application PDF outlining these specific requirements:

Source: Notice of Application Acceptance for Personal Use Cannabis Licenses

Letter of Commitment vs. COI

Here’s the thing; cannabis companies shouldn’t purchase insurance before the Commission formally approves them for a license. If this is your game plan, we encourage you to reconsider your route. Of course, you must have a plan for liability insurance to avoid getting docked ten points on your score.

At AlphaRoot, we have been providing our prospects and current clients vying for New Jersey licenses a “letter of commitment.” It states, “AlphaRoot LLC and our carrier partners have engaged (Company) and discussed their insurance needs. In the event that (Company) is awarded the license with the city, we will work on (Company) behalf to obtain the necessary quotes and limits outlined by the city of (City) (State) as evidenced by a (Company) certification of insurance.”

Additionally, the referenced insurance quotes include the following lines of coverage:

- Commercial General Liability

- Products Liability

- Property

- Workers’ Compensation

Our goal is to put our clients and prospects in the best position to be awarded a license. It doesn’t make sense to have insurance in place before you even know if you will receive a license — but the application requires a plan for liability insurance. It might seem like a Catch-22; however, a letter of commitment is a fantastic alternative for companies that don’t have insurance in New Jersey and can’t provide a COI.

Recommended Coverages for Cannabis Companies

Roughly half of New Jersey’s Notice addresses insurance-related considerations, so it only makes sense to unravel several vital coverages for building your risk management plan. Moreover, many insurance policies can seem complicated, with varying enhancements and exclusions. We will touch on this later, but having a seasoned broker in your corner can make all the difference.

General Liability

General liability coverage protects companies against basic business risks, including bodily injury and property damage on the premises. Most states require cannabis companies to carry the policy, and it’s often teamed with product liability insurance.

Product Liability

Product liability insurance protects cannabis companies from third-party liability exposure, alleging a product caused injury or damage. With federal regulations ever-changing, companies must prepare a legal defense to prove their products are safe. As mentioned, general liability and product liability typically go hand-in-hand, and most states require these policies.

Directors & Officers

Directors and officers (D&O) insurance covers directors and officers from investor lawsuits involving mismanagement of company funds, misrepresentation, etc. For any company relying on outside investment, this coverage is critical. Plus, most board of directors require it.

Property

Property coverage is a first-party insurance policy, reimbursing cannabis companies for direct property loss. This policy covers a company’s equipment and buildings used throughout daily operations.

Crime

Whether employees steal from you, a thief robs your armored car, or you receive a forged check or fraudulent wire transaction, money theft happens in many ways. Crime insurance guards your cannabis company against damages from these particular crimes.

Workers’ Compensation

Most states, including New Jersey, require businesses to carry workers’ compensation coverage. Employers are typically responsible for their medical costs and lost wages when employees sustain work-related injuries. This policy covers these expenses, protecting employees while keeping businesses running smoothly.

Employment Practices Liability

Employment practices liability (EPL) is a labor law coverage that responds to claims arising from invasion of privacy, wrongful termination, sexual harassment, etc. We recommend it as standard coverage for cannabis companies with any number of employees in the current legal landscape.

Vertical Specific Coverage Considerations

Besides some basic insurance coverages, some cannabis companies require a more tailored approach. For example, a cannabis cultivator might want to purchase crop coverage, while a delivery business could opt for an auto policy. On that note, the following are a handful of coverages designed for specific verticals.

Crop Coverage

As a type of property coverage, crop insurance covers crop loss due to a physical loss by a covered peril. For example, consider a fire in the facility and the damage it would cause to the company’s facilities and crops.

Auto Liability Insurance (Owned & HNOA)

Owned auto insurance provides first-party property damage coverage for your vehicle and bodily injury coverage to uninsured or underinsured motorists. HNOA includes coverage for third-party property damage and bodily insuring resulting from accidents during your business.

Cyber Liability

Cyber liability insurance protects cannabis companies from third-party lawsuits relating to electronic activities (i.e., phishing scams). Plus, it offers many recovery benefits, supporting data restoration and reimbursement for income lost and payroll spent.

Partner With a Cannabis Specialist

Acquiring cannabis insurance for your New Jersey cannabis company shouldn’t be a massive headache — but it can be when you go it alone. Some legacy players tuck their cannabis coverages away on their websites, making it hard to explore your possibilities. And we get it. Cannabis isn’t a secret; cannabis insurance shouldn’t be a secret.

Still, a commercial insurance broker can help you understand policy language and various options to customize your plan. Consider the top insurance requirements cannabis companies encounter and whether you can manage them.

Remember to do your homework and genuinely understand what a commercial insurance broker does. Our sister company, Founder Shield, published a helpful piece about this topic: What’s the Role of a Commercial Insurance Broker.

We encourage you to partner with a broker who knows the cannabis industry inside and out. Risk management knowledge is invaluable, but combine that with cannabis expertise, and your broker can help you use your insurance plan as a shield and a sword. Take it from us; that’s what you want.

Protecting your cannabis company can seem confusing; however, we’re a full-service insurance brokerage working with carriers worldwide to offer you the best coverage possible. We’re here to help! Please reach out to us today by emailing info@alpharoot.com or calling 646-854-1093 for a customized letter of commitment or learning more about your cannabis insurance options.