Key Takeaways from the MJBizCon Next Conference

The MJBizCon Next Conference in New Orleans provided valuable insights into the evolving cannabis industry, highlighting the rise of hemp, the importance of effective risk management, and the growing interest from investors. Key discussions included regulatory changes, market consolidation trends, and the shifting dynamics of consumer preferences within the sector.

The Alpharoot conference team recently traveled down to the land of sidewalk beers and muddy water to attend the MJBizCon Next Conference in New Orleans. The goal of the event was to keep up to date on industry trends in order to pass on this knowledge to our existing clients and industry partners.

Kicking off the week was keynote speaker Anat Baron, the force behind Mike’s Hard Lemonade – Not a big deal. Her message on branding, customer focus, and industry development set the tone for the week. In an industry bogged down by regulatory uncertainty and state licenses it’s often easy to forget the customer that makes it all possible.

The AlphaRoot conference team learned many interesting things from the conference and summarized some of the key takeaways below!

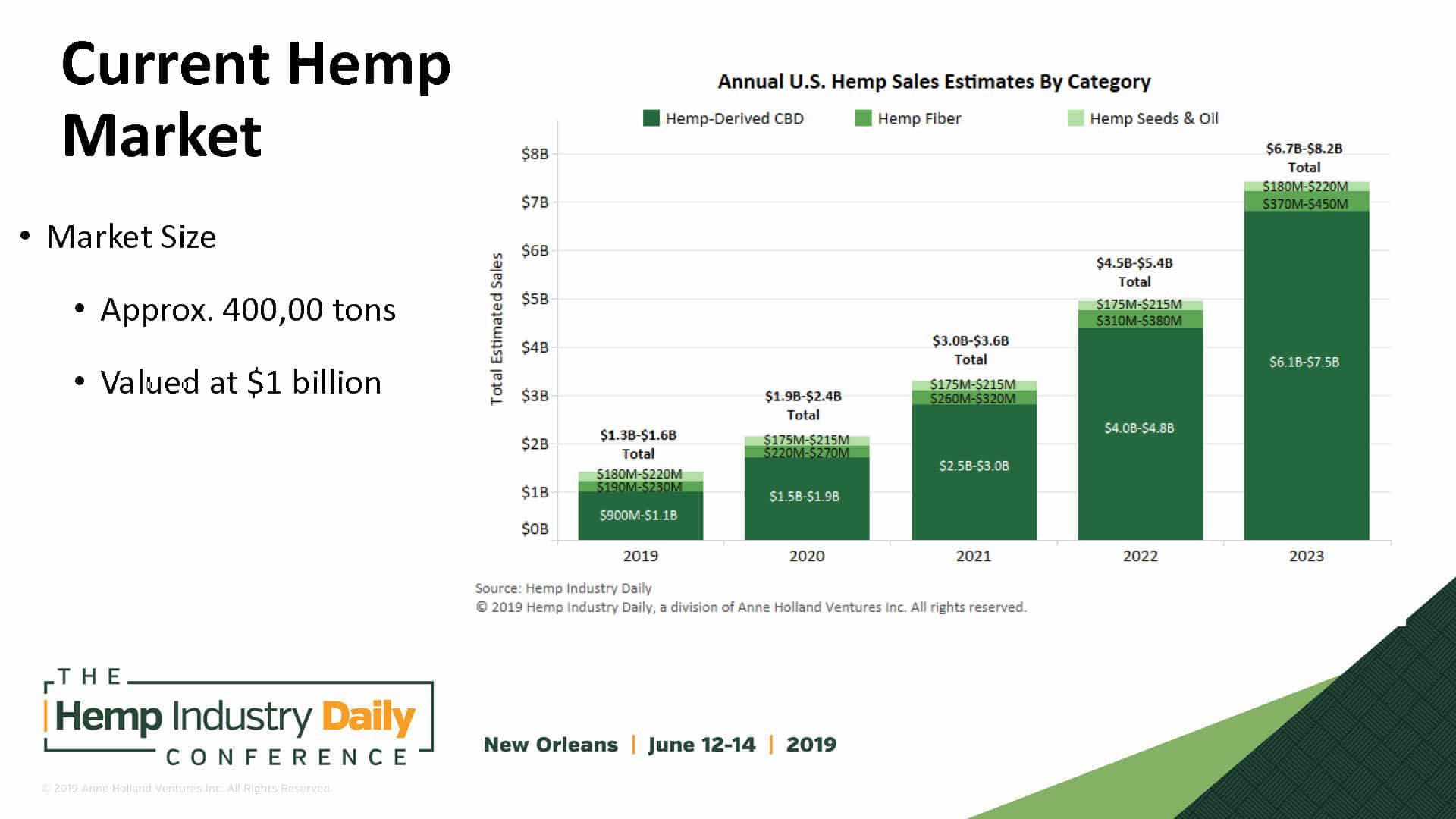

Alpharoot conference team takeaways: Hemp is on the Rise!

The US Senate passed the Farm Bill in Dec. 2018 leading to important changes in how hemp is perceived from a regulatory perspective. The Farm Bill states that hemp is no longer defined as a controlled substance. The USDA will take federal authority over hemp as opposed to the FDA. This has massive legal implications on how companies in the hemp and CBD space can be monetized.

A Few Key Takeaways:

- The term “marihuana” (spelling chosen by legislatures!) no longer includes “hemp”

- Interstate transportation of hemp and CBD is now permissible for sourced products

- States are not waiting on direction from the federal government – the USDA will accept state regulatory plans as the primary regulatory authority

- Although the FDA no longer controls regulation over hemp they still are not putting their stamp of approval on food, beverage, and cosmetic products which includes CBD

- Big brands outside of the hemp industry are looking to get involved while notable c-suite executives are making the jump from industries like the Pharma sector.

With hemp and CBD products being produced in a more favorable legal climate and companies in the space seeing growth opportunities through strategic partnerships and significant c-suite hirings. The space is ripe for fast and aggressive expansion. Launching new products and brands and presents a lucrative opportunity for new entries. At the same time, companies will have to have their ducks in a row to keep up with what is becoming a crowded space.

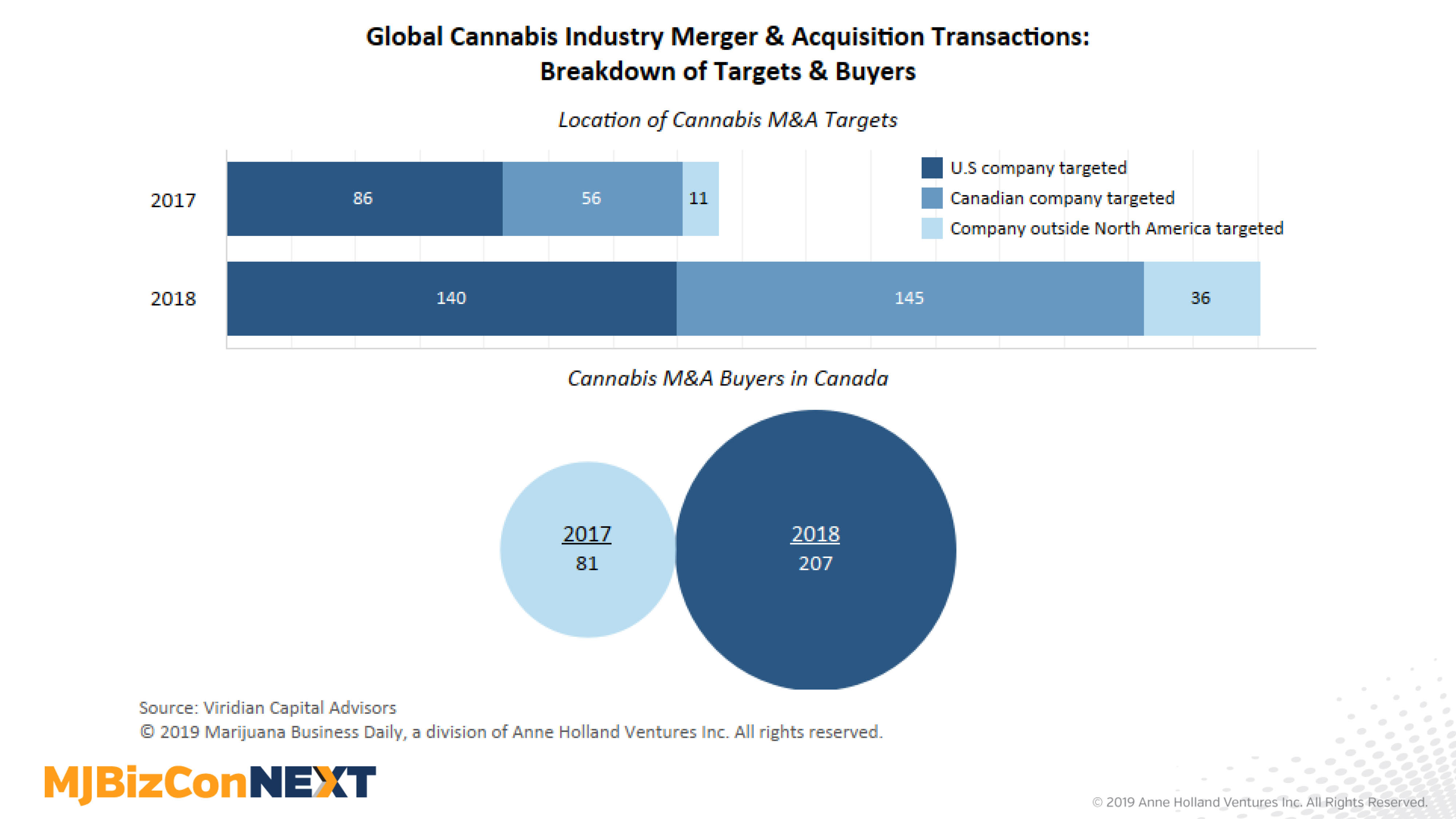

More Consolidation Is On The Horizon

With the growth in size and scope of Multi-State Operators (MSOs), market share is being sought through acquisition. Licensed entities within particular states are being targeted by larger MSOs in pursuit of a greater national foothold as recreational use expands. This is leading to additional regulatory hurdles at the state level as state regulators must adjust from overseeing state-owned and operated entities to large vertically integrated corporations, often with an international presence.

Companies in the Cultivation & Retail space have been the majority of acquirers due to this consolidation trend.

MSO Growth

As MSOs grow in size and access to capital becomes more abundant, 2019 saw increased M&A activity.

- Rise of Multi-State Operators (MSOs)

- Trulieve: $44.5M (4 states)

- MedMen: $36.2M (6 states)

- Curaleaf: $32M (12 states)

- Green Thumb: $28M (11 states)

- Cresco Labs: $21.1M (11 states)

- Harvest Health: $19.2M (8 states)

- Acreage Holdings: $12.9M (20 states)

- 2019 M&A to Date:

- 94 M&A Deals

- 51.6% YOY Growth / # of Deals

- Cultivation & Retail continues to be the most active Cannabis sector

- Focus has shifted to the United States as opposed to Canada in the following years

Risk Management Considerations

Effective risk management in a consolidatory environment is critical. Insurance programs must scale alongside the business and reflect any changes in operations like mergers and acquisitions. Companies considering selling to MSO’s often aren’t aware of the insurance implications leading up to a favorable exit. We strongly recommend that companies in this situation evaluate solutions available like D&O tail coverage to protect their exposure post-acquisition!

Investors Want In

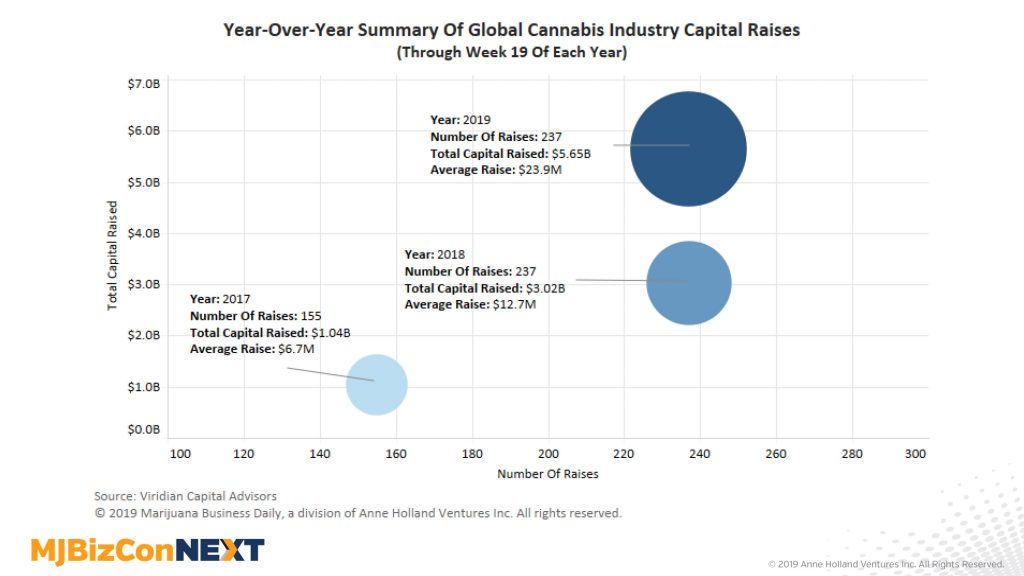

Cannabis companies are seeing increasing interest in funding from venture firms. Cannabis is continuing to be an attractive investment opportunity as more states legalize recreational use. Previously, private lending or even personal loans was the primary fundraising method in the hemp and cannabis space but as companies continue to scale into multi-state operators they are beginning to see more access to traditional capital investments.

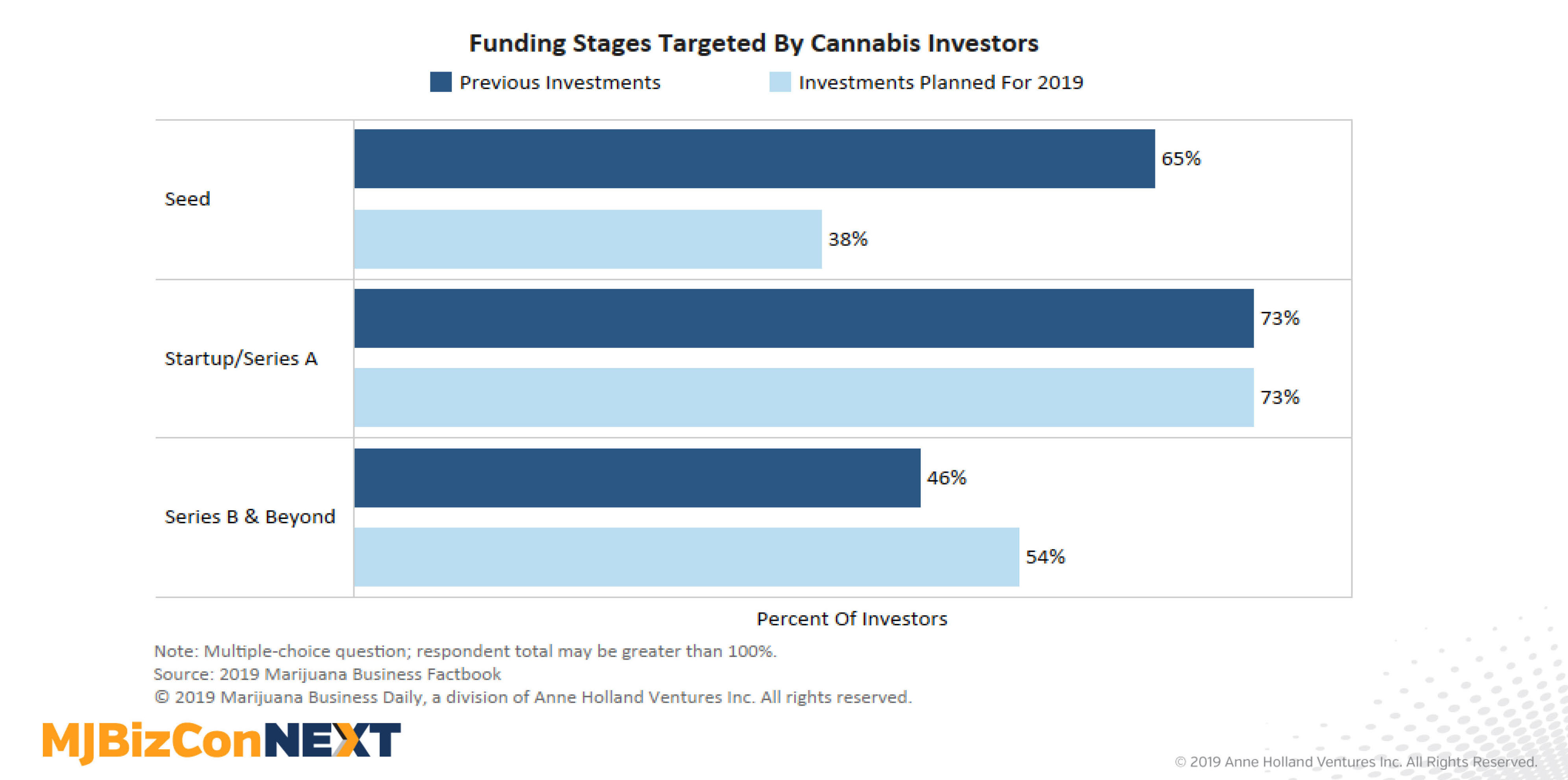

Right now, investors are primarily looking to participate in funding for more mature companies as they are looking at Series A and Series B investments rather than pre-seed or seed rounds. This indicates that growth in the space is steady and will continue.

Key Points

Here are some of the key factors investors are looking for when considering funding new and growing companies:

- They want to trust the individuals running the company! Investors are looking for opportunities to mentor leaders in the space and collaborate on growth and expansion plans.

- Unrealistic projections can kill momentum. It is easy to get excited about growth opportunities, especially for MSOs, but investors want to see realistic projections and proformas to ensure that the companies they are working with are taking a smart approach to competing in a crowded space.

- Fast is not always best. Depending on the fund, investors are looking to make an exit in 5-6 years. They understand that factors influencing growth will come (i.e. regulation, consolidation) and are looking to partner with companies who share their virtues on patience and strategic planning.

On an even more exciting note, Canada is continuing to present itself as a ripe opportunity for public offerings in the cannabis space. The US right now is counting to be strict when considering listing cannabis companies as there has yet to be proven successful as regulation continue to develop. With that, Canada has proven to be a viable option for companies looking to raise capital in the public sector.

With investment comes risk of course. For companies looking to raise privately, they can face exposure from disgruntled investors. Right now investors are working on strict guidelines and if they feel there is mismanagement, misrepresentation, or mishandling of funds there is no hesitation to bring action. On the other side of things, companies going public can face class action risk is shareholders sniff any wrongdoing (as seen with Cronos’s case from 2018).

One Hitters

Finally, check out some other interesting trends we took from the conference:

- Hot! Illinois was the first state to legalize recreational marijuana through legislature and is projected $2-2.5B in eventual annual sales.

- Cold! NY, NJ, CT, VT, NH failed to legalize recreational marijuana. We are located in NY 🙁

- Hot! Southern Markets. Although southern US states present challenges based on cultural and political climates several states such as LA, GA, AR, and FL have legalized medical marijuana while FL is progressing toward recreation use which could come in 2020. MS, AL, NC, SC, and TN are other states to watch as well.

- Cold! Flower sales are down.

- Hot! And in turn vapor and edibles are increasingly taking more market share.

Manage Your Risk with the Right Broker

The insurance landscape is always changing, especially in new industries, and making sure your risk management practices are favorable is key to limiting risk as your company grows. AlphaRoot specializes in insuring retail and e-commerce operations in the hemp and CBD space, please speak with us about your product liability and cyber liability coverage!

AlphaRoot has handled D&O placements high growth companies in other emerging industries and we are well equipped to help you! If you are looking to IPO our experience in both the US and Canada will be an asset for your company as well to make sure you are protecting your company and the individuals who make it go!

Please reach out to us at info@alpharoot.com or (646) 854-1058 for a consultation to get ahead of the game as capital is being made increasingly available!