Ohio Cannabis Laws Explained [UPDATED]

In 2023, Ohio became the 24th state to legalize recreational cannabis, marking a significant change in its legal framework. This development not only affects individuals but also has implications for businesses, especially those seeking cannabis insurance. Understanding Ohio’s cannabis laws is essential for compliance and navigating the evolving landscape of the industry, which includes regulations on possession, cultivation, sales, and insurance requirements.

In November 2023, Ohio proudly became the 24th state in the U.S. to legalize adult-use cannabis, introducing a pivotal shift in its legal landscape. This transformative move impacted individuals and sparked interest in weed insurance in Ohio. Considering the dynamic realm of cannabis insurance, understanding Ohio’s cannabis laws is not just about compliance; it’s crucial for businesses.

AlphaRoot explores the core of Ohio’s weed laws, shedding light on the nuances that define the state’s stance on cannabis, ultimately shaping the landscape for weed insurance seekers.

The Ohio Cannabis Laws

Ohio’s cannabis landscape has undergone a significant transformation, with its current laws shaping access and operations across the state.

The Legalization of Ohio Cannabis

Medical marijuana has been legal in the state of Ohio since September 2016. The Ohio Medical Marijuana Control Program (OMMCP) allows people with certain medical conditions to purchase and use medical marijuana upon the recommendation of an Ohio-licensed physician certified by the State Medical Board of Ohio.

With its legalization in late 2023, Ohio has embraced a transformative shift in its cannabis legislation, marking its status as the 24th state to legalize recreational cannabis (also known as non-medical marijuana). This legal framework impacts businesses and individuals alike, prompting a surge of interest in weed insurance in Ohio.

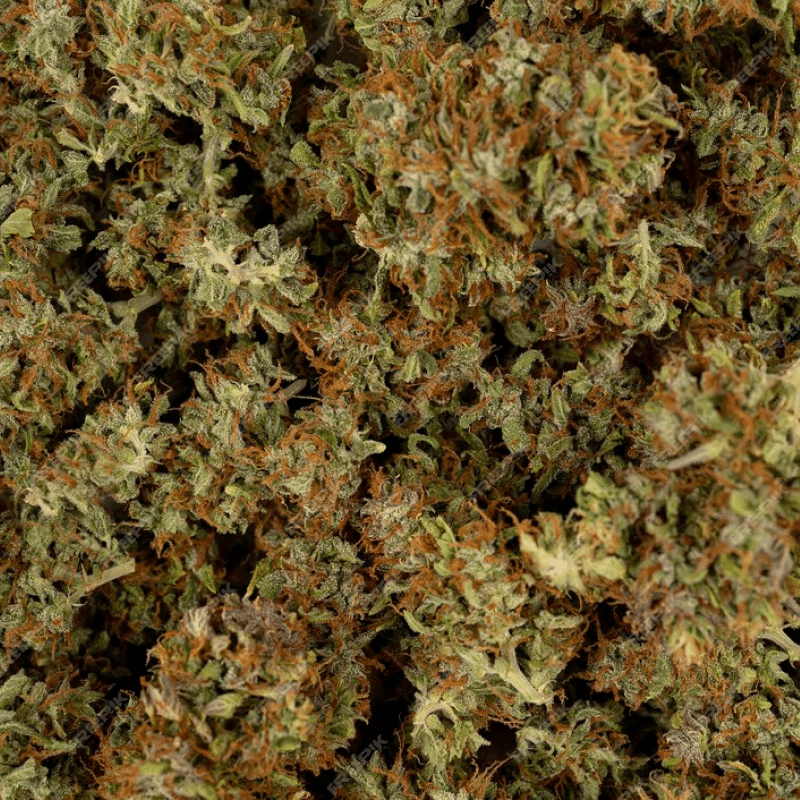

Possession and Cultivation

Ohio’s approach to cannabis possession and cultivation is marked by stringent regulations. While registered patients can possess a 90-day supply for medical use, home cultivation faces restrictions. For example, individuals can only cultivate, grow, and possess up to six cannabis plants at their primary residence. This distinction is important for those looking into cannabis insurance in the state.

For more information on possession and cultivation laws, check out the Ohio Revised Code on Adult Use Cannabis Control.

Sale and Distribution

The sale and distribution of cannabis in Ohio are subject to strict regulations. The state is currently in the process of transitioning medical dispensaries to dual-use operations, allowing them to sell recreational cannabis. Only dispensaries with an existing medical marijuana license can apply for these dual-use Certificates of Operation.It’s important to note that only dispensaries with a license to sell medical marijuana can apply for a dual-use license.

The evolving cannabis market in the state of Ohio has created a need for comprehensive weed insurance. This is crucial for entrepreneurs and investors looking to safeguard their interests in this dynamic industry.

The Imperative of Cannabis Insurance in Ohio

Learn about protecting your Ohio cannabis venture with cannabis insurance. Explore rules and coverage to ensure your business thrives within the state’s legal framework.

Ohio Cannabis Insurance: Beyond Traditional Policies

In Ohio’s evolving cannabis industry, obtaining comprehensive weed insurance is a strategic imperative. This specialized coverage extends beyond traditional business policies, addressing the unique risks associated with the cultivation, distribution, and sale of cannabis.

From crop protection to liability coverage, cannabis insurance serves as a crucial financial safety net for businesses navigating the complexities of the legal framework.

Regulatory Compliance

Cannabis insurance in Ohio aligns with state regulations, ensuring that businesses meet legal requirements. Understanding and complying with these standards is crucial for obtaining and maintaining comprehensive insurance coverage for your cannabis business in the state. This helps mitigate risks, protect assets, and operate confidently in a highly regulated industry.

Safeguard Your Investment

Medical vs. Recreational Cannabis

In Ohio, the legalization of cannabis caters to two distinct purposes under its evolving legal framework. Medical cannabis, legalized in 2016, is exclusively available to registered patients diagnosed with qualifying medical conditions. This segment adheres to a more controlled and regulated distribution process.

On the other hand, recreational cannabis, also known as non-medical or adult-use cannabis, was only legalized in November 2023. However, strict cannabis laws in Ohio still govern product distribution. As of August 2024, only dispensaries with an existing license to sell medical marijuana can apply for a dual-use license to also sell recreational marijuana.

Cannabis Taxation in Ohio

Weighing Ohio’s cannabis taxation is integral for businesses in this evolving industry. The state currently imposes specific taxes on cannabis sales. Medical cannabis is subject to a 5.75% sales tax, while recreational cannabis faces a 10% excise tax on top of the state’s 5.75% sales tax.

These tax percentages impact pricing structures and financial considerations for businesses. Understanding Ohio’s taxation framework, with its distinct percentages for medical and recreational cannabis, is crucial for financial planning.

Businesses keen on comprehensive weed insurance coverage must factor these tax nuances into their strategic considerations in Ohio’s dynamic cannabis market.

The Bottomline

As Ohio continues to navigate the evolving cannabis industry, staying informed and compliant with state laws is essential for business success. Whether you’re focused on medical or recreational cannabis operations, understanding the intricacies of regulations surrounding licensing, taxation, and compliance is crucial. These elements not only impact the day-to-day operations of your cannabis business but also play a vital role in securing comprehensive cannabis insurance coverage tailored to the unique risks of the industry.

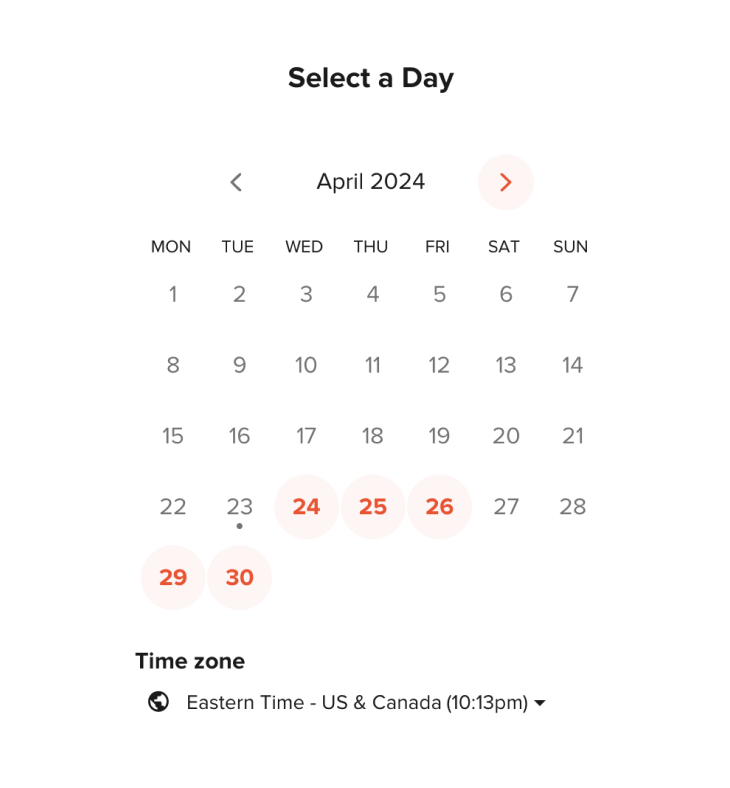

Looking for a trusted insurance partner to safeguard your cannabis business in a rapidly changing industry? Schedule a meeting with us today to explore customized coverage solutions that will protect your business and set you up for long-term success.