Cannabis Trends and Stats 2025-2026

The U.S. cannabis industry in 2025 marked a year of transition.

This 2025 cannabis industry year-in-review examines the latest U.S. cannabis statistics, market trends, and regulatory updates that defined the year. From market size and sales performance to emerging risks and growth opportunities, this guide offers a clear, data-driven assessment of the cannabis industry’s current state and key considerations for businesses moving forward.

- Opportunities In The Cannabis Industry

- Opportunities In The Cannabis Industry

- U.S. Cannabis Legalization Overview

- U.S. Cannabis Legalization Overview

- Trends in Cannabis Consumption

- Trends in Cannabis Consumption

- Understanding the Health Risks of Cannabis Use

- Understanding the Health Risks of Cannabis Use

- Turn Cannabis Industry Uncertainty into Opportunity

- Turn Cannabis Industry Uncertainty into Opportunity

Opportunities In The Cannabis Industry

America saw a swift change in people’s perception regarding cannabis a few years back. While federal legalization of cannabis is still pending, more than half of all U.S. States allow some form of cannabis usage.

Following the legalization and the market’s growing CAGR (Compound Annual Growth Rate), more startups are being established ultimately creating more job opportunities.

Here are some things you need to know about the opportunities within the cannabis industry:

Opportunities In The Cannabis Industry

America saw a swift change in people’s perception regarding cannabis a few years back. While federal legalization of cannabis is still pending, more than half of all U.S. States allow some form of cannabis usage.

Following the legalization and the market’s growing CAGR (Compound Annual Growth Rate), more startups are being established ultimately creating more job opportunities.

Here are some things you need to know about the opportunities within the cannabis industry:

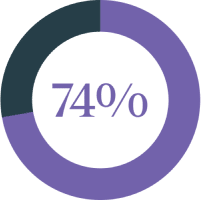

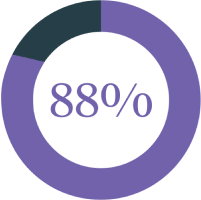

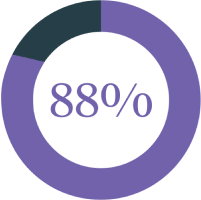

88% of Americans

An overwhelming majority of U.S. adults (88%) say that marijuana should either be legal for medical use only (32%) or that it should be legal for medical and recreational use (57%).

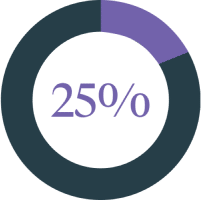

25% of all dispensaries

California has more dispensaries than any other state. As of February 2024, the state has 3,659 dispensaries, more than double the amount in the second-highest-ranking state.

42 U.S. States

As of June 2025, the medical use of cannabis has been legalized in 42 states and the District of Columbia.

88% of Americans

An overwhelming majority of U.S. adults (88%) say that marijuana should either be legal for medical use only (32%) or that it should be legal for medical and recreational use (57%).

Trends in Cannabis Consumption

As the cannabis market matures, consumption trends are becoming more nuanced. Data from 2025 highlights meaningful shifts in how consumers use cannabis, which products they prefer, and who is driving growth across legal markets.

15% of active marijuana users

Data from Gallup (2023 and 2024) shows that 15% of Americans are active marijuana users. 42% are considered “intensive users,” meaning they consume daily or near-daily.

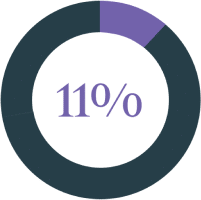

62% of consumers

There’s a cultural trend in the rise of cannabis as a replacement for alcohol and other drugs. 62% of consumers said that when they have a choice between cannabis and alcohol, they choose cannabis.

Alcohol Replacement

A survey from CivicScience found that 21% of people doing Dry January are replacing alcohol with cannabis and CBD.

Benefits for PTSD

Cannabis effectively reduces anxiety and depression symptoms in people with post-traumatic stress disorder.

Trends in Cannabis Consumption

As the cannabis market matures, consumption trends are becoming more nuanced. Data from 2025 highlights meaningful shifts in how consumers use cannabis, which products they prefer, and who is driving growth across legal markets.

Understanding the Health Risks of Cannabis Use

As cannabis use continued to grow, research increasingly focused on its potential health risks. While it may offer benefits for some users, studies throughout the year reinforced the importance of understanding how cannabis use can affect cognitive function, dependency risk, mental health, and prenatal development, especially among younger users and other vulnerable populations. The statistics below highlight key health-related findings from 2025 to support informed decision-making in an evolving cannabis landscape.Understanding the Health Risks of Cannabis Use

As cannabis use continued to grow, research increasingly focused on its potential health risks. While it may offer benefits for some users, studies throughout the year reinforced the importance of understanding how cannabis use can affect cognitive function, dependency risk, mental health, and prenatal development, especially among younger users and other vulnerable populations. The statistics below highlight key health-related findings from 2025 to support informed decision-making in an evolving cannabis landscape.Turn Cannabis Industry Uncertainty into Opportunity

The cannabis industry in 2025 proved that opportunity and risk continue to move hand in hand. Market growth, evolving regulations, shifting consumer behavior, and increasing scrutiny have made it clear that success in cannabis requires preparation, not just momentum.

AlphaRoot specializes exclusively in the cannabis industry, helping operators navigate risk with tailored insurance and risk management solutions designed for the realities of this market. From cultivation and manufacturing to retail and ancillary businesses, our approach goes beyond traditional coverage to address compliance challenges, operational exposure, and long-term resilience.

As the industry continues to mature, having the right protection in place is a strategic advantage. AlphaRoot is here to help you move forward with confidence, knowing your business is protected by a team that understands cannabis inside and out.

Ready to protect what you’ve built?

Get a quote today and see how AlphaRoot can support your cannabis business in the year ahead.

Get A Quote NowTurn Cannabis Industry Uncertainty into Opportunity

The cannabis industry in 2025 proved that opportunity and risk continue to move hand in hand. Market growth, evolving regulations, shifting consumer behavior, and increasing scrutiny have made it clear that success in cannabis requires preparation, not just momentum.

AlphaRoot specializes exclusively in the cannabis industry, helping operators navigate risk with tailored insurance and risk management solutions designed for the realities of this market. From cultivation and manufacturing to retail and ancillary businesses, our approach goes beyond traditional coverage to address compliance challenges, operational exposure, and long-term resilience.

As the industry continues to mature, having the right protection in place is a strategic advantage. AlphaRoot is here to help you move forward with confidence, knowing your business is protected by a team that understands cannabis inside and out.

Ready to protect what you’ve built?

Get a quote today and see how AlphaRoot can support your cannabis business in the year ahead.

Get A Quote Now