Cannabis Insurance

in Rhode Island

With a recreational program in the startup phase in December 2022, protecting your growing investment is a critical and long-term investment. With unique exposure to cannabis insurance, only the proper insurance can provide the security you need from employees to consumers.

- Introduction to Cannabis Insurance in Rhode Island

- Navigating the Risks: Why Insurance is Essential

- Comprehensive Coverage: Types of Cannabis Insurance Available

- Benefits of Having the Right Cannabis Insurance

- AlphaRoot Cannabis Insurance: Tailored Solutions for Your Business

- Cannabis Insurance FAQs

- Speak to a Cannabis Insurance Advisor

Introduction to Cannabis Insurance in Rhode Island

Cannabis insurance is a crucial aspect for businesses operating within Rhode Island’s burgeoning cannabis industry. With legalization paving the way for numerous opportunities, it’s imperative for business owners to understand the specific insurance needs to safeguard their operations. This guide will explore the various types of insurance available, the importance of coverage, and how to navigate the complexities of cannabis insurance in Rhode Island.

Overview of Rhode Island's Cannabis Industry

Rhode Island’s legal cannabis industry is flourishing because both medicinal or recreational use is allowed. Established in 2005, the medical marijuana program boasts over 11,000 patients served by 7 compassion centers and 60 cultivators. Adult-use cannabis joined the scene in December 2022, overseen by the newly formed Cannabis Control Commission. The market is thriving, with sales up 31% in 2023 and flower products leading the charge. However, challenges are emerging. A potential cultivator surplus looms, advertising regulations remain unclear, and questions surround the possibility of hosting public cannabis events.

Rhode Island Cannabis Laws and Regulations

Rhode Island’s cannabis laws are governed by the Office of Cannabis Regulation (OCR). They also introduced a three-member Cannabis Control Commission (CCC). The Rhode Island Cannabis Act, passed in May 2022, legalized adult-use cannabis. Businesses must adhere to strict guidelines to maintain their licenses and operate legally within the state.

Understanding the Importance of Insurance for Cannabis Businesses

Insurance is vital for cannabis businesses due to the unique risks associated with the industry. From product liability to property damage, having comprehensive insurance coverage ensures that businesses are protected against unforeseen events and legal challenges.

Comprehensive Coverage: Types of Cannabis Insurance Available

Several types of cannabis insurance products are available to cover different aspects of cannabis businesses in Rhode Island.

General liability insurance protects against claims of bodily injury, property damage, and personal injury. It is essential for covering legal fees and settlement costs arising from accidents or incidents on business premises.

Learn MoreCannabis crop insurance provides coverage for the loss of plants due to natural disasters, pests, or other catastrophic events. This insurance is crucial for cultivators to protect their valuable crops. Outdoor crops are more exposed to natural threats making the costs of insurance coverage a little more high.

Learn MoreProduct liability coverage covers claims related to product defects that cause injury or illness to consumers. This is particularly important for manufacturers and dispensaries to safeguard against lawsuits and recalls.

Learn MoreProperty insurance covers commercial property, including buildings, equipment, and inventory. It protects against damages from fire, theft, and other perils, ensuring that the business can recover from significant losses.

Learn MoreD&O insurance protects the personal assets of corporate directors and officers in the event of legal actions against them for alleged wrongful acts in their capacity as leaders of the company.

Learn MoreWorkers’ compensation insurance provides medical benefits and wage replacement to employees injured on the job. Casualty insurance should also be included. It is a mandatory coverage that helps businesses comply with state regulations and support their workforce. It’s a great part of the employee benefits.

Learn MoreBusiness interruption insurance covers the loss of income due to disruptions caused by covered perils, such as fire or natural disasters. This insurance helps businesses maintain financial stability during recovery periods.

General liability insurance protects against claims of bodily injury, property damage, and personal injury. It is essential for covering legal fees and settlement costs arising from accidents or incidents on business premises.

Learn MoreCannabis crop insurance provides coverage for the loss of plants due to natural disasters, pests, or other catastrophic events. This insurance is crucial for cultivators to protect their valuable crops. Outdoor crops are more exposed to natural threats making the costs of insurance coverage a little more high.

Learn MoreProduct liability coverage covers claims related to product defects that cause injury or illness to consumers. This is particularly important for manufacturers and dispensaries to safeguard against lawsuits and recalls.

Learn MoreProperty insurance covers commercial property, including buildings, equipment, and inventory. It protects against damages from fire, theft, and other perils, ensuring that the business can recover from significant losses.

Learn MoreD&O insurance protects the personal assets of corporate directors and officers in the event of legal actions against them for alleged wrongful acts in their capacity as leaders of the company.

Learn MoreWorkers’ compensation insurance provides medical benefits and wage replacement to employees injured on the job. Casualty insurance should also be included. It is a mandatory coverage that helps businesses comply with state regulations and support their workforce. It’s a great part of the employee benefits.

Learn MoreBusiness interruption insurance covers the loss of income due to disruptions caused by covered perils, such as fire or natural disasters. This insurance helps businesses maintain financial stability during recovery periods.

Expert Advice: Choosing the Right Cannabis Insurance Policy

Selecting the appropriate insurance policy requires careful evaluation of your business’s unique needs and potential risks. The cannabis insurance industry is a very competitive industry, that’s why parterning up with the right company like AlphaRoot ensures that your business will recover from unwanted and inevitable liabilities.

How to Evaluate Your Insurance Needs

Evaluate your insurance needs by assessing the specific risks associated with your operations, including the size of your business, the nature of your products, and your exposure to potential liabilities.

Factors to Consider When Choosing Cannabis Insurance

Consider factors such as the coverage limits, exclusions, and the reputation of the insurance provider. It’s essential to choose a policy that offers comprehensive protection tailored to your business’s requirements.

Benefits of Having the Right Cannabis Insurance

AlphaRoot is licensed to provide cannabis insurance coverage throughout Tennessee, not to mention dispensary insurance, across the entire US.

Protecting Your Investment

AlphaRoot is not in the insurance business. We’re in the business of guiding cannabis companies through the unique risks of our industry. It’s why we don’t merely broker insurance, we curate powerful cannabis risk management solutions.

Managing Risks and Liability

Insurers looking to provide commercial cannabis insurance to this budding market should understand its rapidly shifting landscape. They must contend with legal uncertainty, evolving regulations, lack of data, and developing business practices. Insurers will also need to understand how the cannabis industry’s first and third‐party coverage needs are unique from other industries.

Meeting Legal Requirements

Currently, there are no state-defined guidelines for opening cannabis businesses in Tennessee. The legal sale of medical cannabis hasn’t begun in the state, and its government is yet to announce any measures they’ve taken for the program.

AlphaRoot Cannabis Insurance: Tailored Solutions for Your Business

AlphaRoot is a full service insurance brokerage that focuses exclusively in the cannabis, hemp, CBD, holistic medicine and psychedelic industries. We work with companies across the entire supply chain, from seed to sale, as well as, ancillary and capital providers. Our team is heavily invested in these industries and our goal is to help companies scale to propel them forward.

Consulting with Cannabis Business Insurance Specialists

Consulting with specialists can help navigate the complexities of cannabis insurance.

Comprehend Unique Risks

Specialists understand the unique risks associated with cannabis businesses and can provide tailored advice.

Navigate Coverage Options

They assist in exploring various coverage options to find the best fit for your business.

Mitigate Financial Loss

Specialists help mitigate financial loss by ensuring comprehensive coverage and adequate protection.

Align with Regulations

They ensure that your insurance policies comply with all state regulations, avoiding legal complications.

Cannabis Insurance FAQs

All cannabis related businesses, including cultivators, manufacturers, dispensaries, delivery services, and ancillary businesses require insurance to protect against industry-specific risks.

Cannabis liability coverage is important because it protects against claims related to product defects, injuries, and other liabilities, ensuring financial stability and legal compliance.

You can reduce premiums by implementing risk management practices, maintaining a clean claims history, and working with an experienced insurance broker to find competitive rates.

If a claim is denied, review the denial letter, understand the reasons, and work with your insurance provider or legal counsel to appeal the decision or find alternative solutions.

Changes in regulations can affect coverage requirements and premiums. Staying informed about regulatory updates and working with knowledgeable insurance professionals ensures compliance and adequate protection.

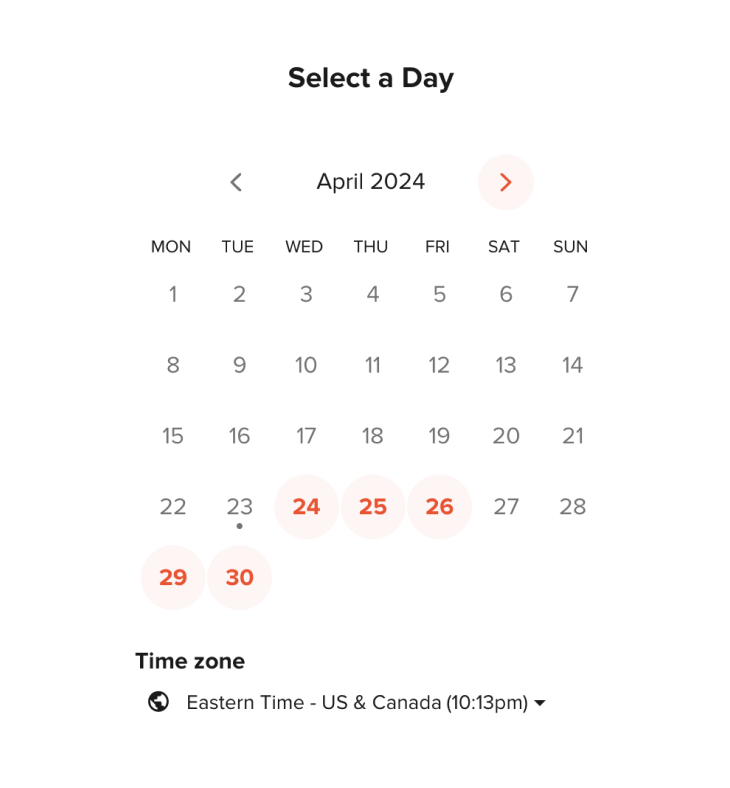

Speak to a Cannabis Insurance Advisor

For comprehensive coverage and expert guidance, get a quote from a trusted cannabis insurance provider. They can help tailor policies to meet your specific needs and ensure your business is fully protected.